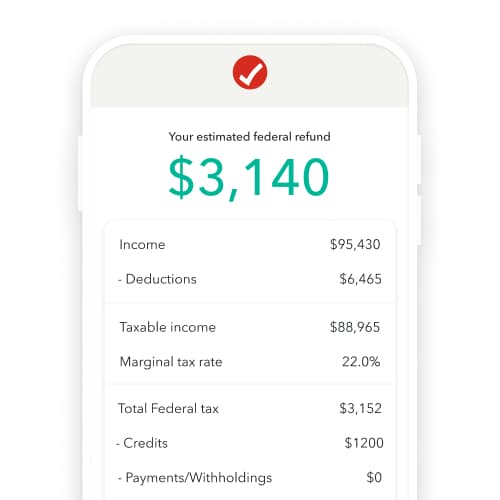

Business Charitable Deductions 2024 Calculator – (Small business owners and certain other people might also be allowed to deduct up to 20% of their qualified business income.) Once you know your taxable income, calculate the tax due for that . Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. .

Business Charitable Deductions 2024 Calculator

Source : turbotax.intuit.comDoucette Accountants & Advisors | Franklin MA

Source : m.facebook.com249,086 Tax Planning Images, Stock Photos, 3D objects, & Vectors

Source : www.shutterstock.comUnderstanding Tax Law Changes and Tax Bracket Adjustments | U.S. Bank

Source : www.usbank.comLaufer LLP | Babylon NY

Source : m.facebook.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comSelf Employed Tax Deductions Calculator 2023 2024 Intuit

Source : blog.turbotax.intuit.comIRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.com5 Trends Fundraisers Need to Watch in 2024

Source : www.philanthropy.comIRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.orgBusiness Charitable Deductions 2024 Calculator Free Tax Calculators & Money Saving Tools 2023 2024 | TurboTax : That’s because the IRS adjusted many of its provisions in 2023 for inflation, pushing the standard deduction to a income and other data into a 2024 tax refund calculator, which are offered . T axpayers who claim the standard mileage rate deduction for the miles they log for business purposes will be able to write off 67 cents per mile in 2024, the IRS recently announc .

]]>

.png)