2024 Schedule A Form 1040 Sr – The Internal Revenue Service (IRS) has released the tax refund schedule for the year 2024 form will now be required to use Form 1040 or Form 1040-SR. The IRS has made this change to simplify . Qualified charitable distributions, otherwise known as QCDs, can be tricky when it comes to tax reporting. We’ve got some pointers to help with filing. .

2024 Schedule A Form 1040 Sr

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

Source : www.irs.govWhat Is Schedule A of Form 1040?

Source : www.thebalancemoney.com1040 (2023) | Internal Revenue Service

Source : www.irs.govbasics – Money Instructor

Source : content.moneyinstructor.com1040 (2023) | Internal Revenue Service

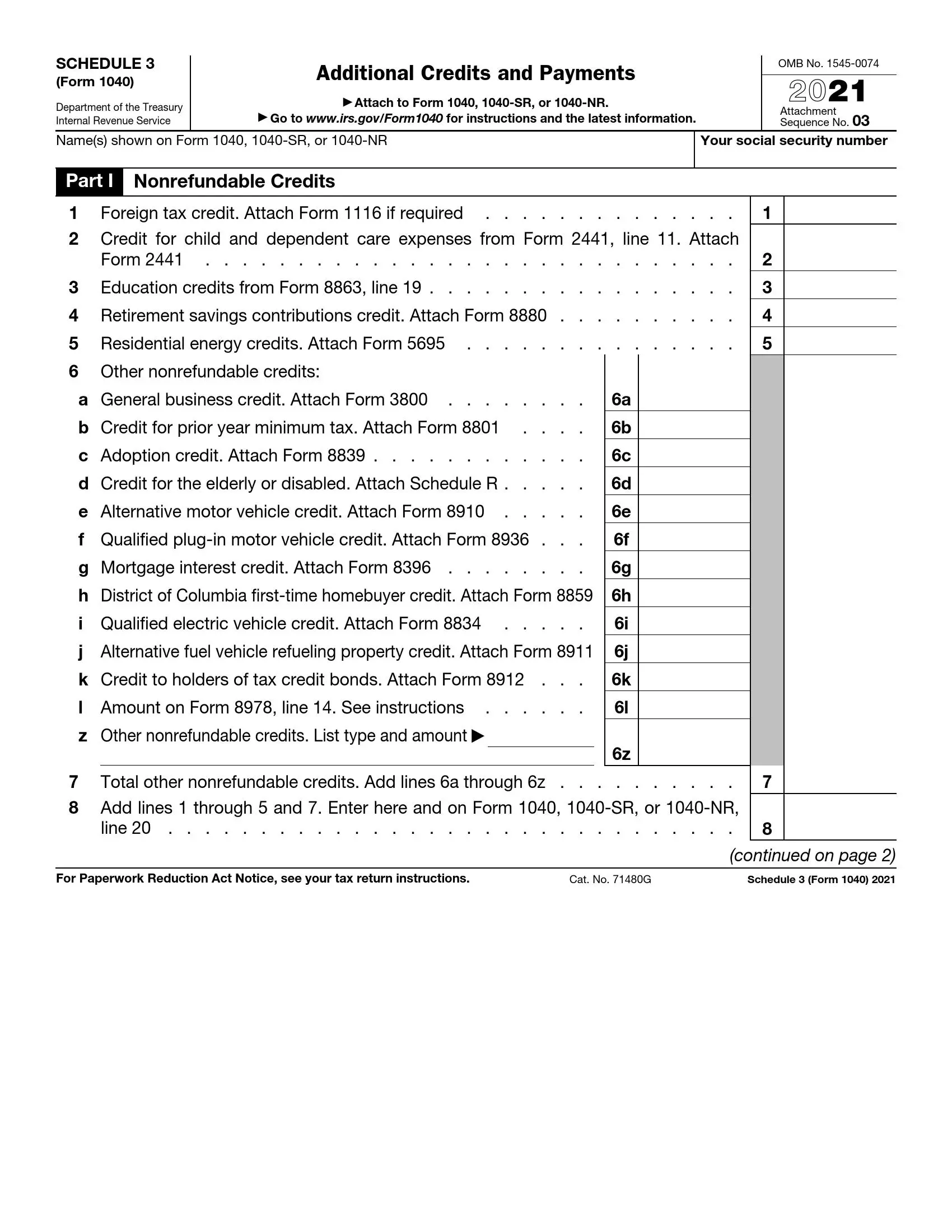

Source : www.irs.govIRS Schedule 3 Form 1040 or 1040 SR ≡ Fill Out Printable PDF Forms

Source : formspal.comSchedule C 2020 2024 Form Fill Out and Sign Printable PDF

Source : www.signnow.com2023 Form 1040 SR

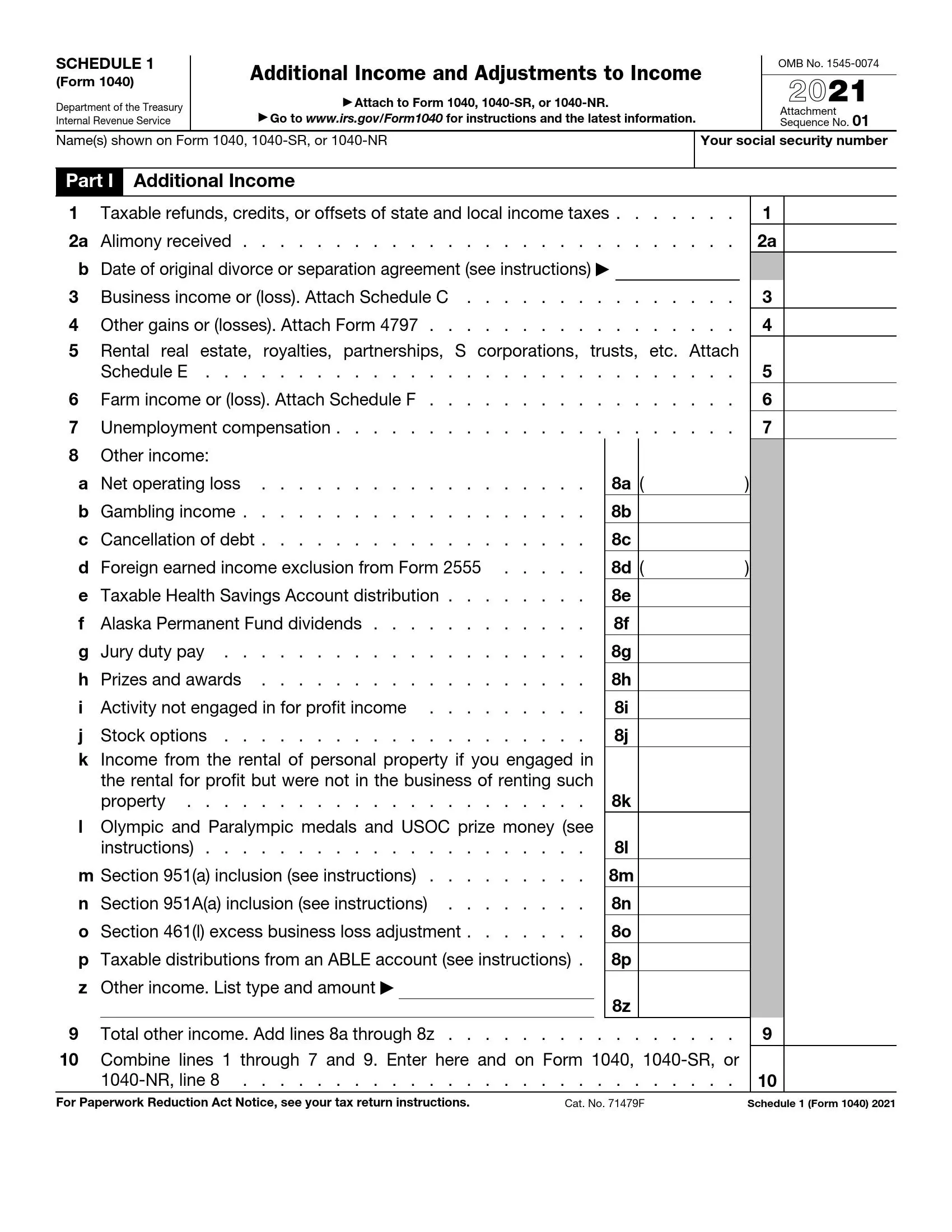

Source : www.irs.govIRS Schedule 1 Form 1040 or 1040 SR ≡ Fill Out PDF Forms Online

Source : formspal.com2024 Schedule A Form 1040 Sr All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: Those who have won money should know that gambling winnings are fully taxable and you’ll have to report the income on your tax return. . If you are a single tax filer and your combined income is between $25,000 and $34,000, the SSA says you may have to pay income tax on up to 50% of your benefits. If you are a single tax filer and your .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-e2490b265c7e42d1b79c9d70835003fd.png)